Japanese Economy

State of the Economy

Despite four years of economic stimulus, Japan’s economy remains only 2.2 per cent bigger in real terms than when Prime Minister Shinzo Abe came to power promising massive structural reforms.

But while Japan’s government is pushing companies to increase investment at home and raise wages to boost demand, stimulate the economy and escape deflation, the pace of improvement remains subdued.

Movements in the bond and currency markets are a barometer of investor expectations about a country’s economic prospects – and those of its rivals. The Japanese Yen in particular tends to benefit from its perceived-safe haven status, particularly when there is turmoil in the Chinese markets.

Japan’s fiscal forecasts are banking on the structural reforms of Abenomics generating an acceleration in productivity growth to 2.2 per cent a year by the 2020s — the level prevailing in the 1980s.

Financial Times

Global growth has slowed abruptly over the past year, with the weakness seen in the latter half of 2018 continuing in the early part of 2019 amidst persisting trade tensions. Trade and investment have moderated sharply, especially in Europe and China, business and consumer confidence have declined and policy uncertainty remains high. At the same time, financial market conditions have eased, helped by moves towards a more accommodating monetary policy stance in many economies, and favourable labour market conditions continue to support household incomes and spending in the major economies. Sizeable fiscal and quasi-fiscal easing is occurring in a handful of countries, including China, but in most economies fiscal policy is offering only limited support for growth. Overall, given the balance of these different forces acting, global GDP growth is projected to ease from 3½ per cent in 2018 to a sub-par rate of 3.2% this year, before edging up to 3.4% in 2020. This slowdown is widespread, with growth set to moderate this year in almost all economies. Trade growth is projected to weaken further this year, to around 2%, the weakest rate since the global financial crisis and checking the speed at which global output growth can rebound from its current soft pace. Inflationary pressures are set to remain mild, with few strains on capacity in most economies.

OECD General Assessment

General Facts & Figures: Major Industries:

Land Area: 377,972 km²

Five Most Industrious Cities:

- Tokyo

- Yokohama

- Osaka

- Nagoya

- Sapporo

- GDP (2017): 4.872 Trillion USD

Currency: Japanese Yen

General Facts & Figures: Major Industries:

Manufacturing – Makes up about 24% of the country’s GDP.

Agriculture – Japan is one of the largest producers of rice.

Fishing – Japan is the world’s 4th largest fishing country.

Tourism – An approximate of 20 million visitors yearly.

Mining – Vast deposits of rare earth metals have been discovered in the coastal areas of Japan.

Service – Accounts for approximately three-quarters of the total output in the economy.

Technology – Japan is the 3rd country with the highest spending worldwide on R&D according to OECD.

Why Japan?

Japan is the 3rd largest economy in the world. With a GDP 1.5 times the size of the UK and GDP per person about 6 times that of China, Japan remains the high-tech powerhouse economy of Asia – with the 2nd highest spend worldwide on R&D, a keen appetite for developing intellectual property and new trends, and an increasingly globalised outlook. Japan’s households hold financial assets of 1,645 trillion yen (more than 300% of GDP). Japan’s major growth driver is exports, despite external demand accounting for 16% of its GDP. Average annual economic growth since 2012 has been around 1%. The IMF expects the economy to grow by 1.5% in 2017 and 0.6% in 2018.

https://www.gov.uk/government/publications/overseas-business-risk-japan/overseas-business-risk-japan

According to the OECD, Economic growth is projected to remain close to only 0.7% in 2019-20, with wage and investment growth sustained by labour and capacity shortages. The temporary effect of the October 2019 consumption tax increase will be mitigated by fiscal measures. Sustained growth is projected to gradually push up headline inflation to 1% (excluding the impact of the tax increase) by 2020

After peaking at 1.9% in 2017, economic growth slowed to 0.8% in 2018, reflecting weaker export momentum as world trade decelerated. Nevertheless, the current expansion, which began in late 2012, is now the longest in Japan’s post-war history, supported by a moderate recovery of consumption and robust business investment. The expansion faltered in early 2019, with declines in industrial production and exports, though labour market conditions remain tight.

http://www.oecd.org/economy/japan-economic-snapshot/

Services for Members

Japan is one of the world’s largest and most attractive markets; at the same time, it is known for its unique business culture which must be thoroughly understood. We staunchly believe in the high potential of Israel-Japan commerce, and invite you to join us and become partners to our activities and success.

Services we offer members of the Israel-Japan Chamber of Commerce:

A variety of activities, business conventions and seminars on various topics relating to business in the Japanese market.

Assistance in finding business partners in Japan and Israel.

Expert panel services – initial assistance and training for companies seeking to do business with the Japanese market, headed by businessmen with extensive experience working with the Japanese market in a variety of industries.

Organization and holding of meetings between businessmen, business delegations and Israeli and Japanese government personnel.

Regular updates on functions being held for the business sector and Japanese cultural events.

Promotion of our members’ services and private advertising in our website’s index of service providers.

A platform for marketing and advertising to a wide community of Japan fans via distribution lists and banner ads in newsletters and on our website.

Organization and conduction of inter-cultural coaching for businesses working with the Japanese market.

A subscription to our monthly newsletter which includes updates on upcoming events and select articles on Japanese current events.

An Isracard Corporate card offering special terms, benefits and discounts at a variety of businesses.

Thanks to the efforts of the Israel-Japan Chamber of Commerce, we hosted a delegation of businessmen from the area of the Kansai region, Japan. The event was held under the auspices of Israel’s largest law firm HFN, Embassy of Japan in Israel and the Israeli Embassy in Japan. The delegation included business executives from the area of the Kansai region looking for future collaborations with several Israeli companies.

The Aging Population in Japan and its Impact

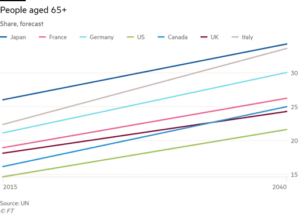

Rapid fertility decline aided by mortality decline has caused the proportion of the Japanese population aged 65 and over to increase from 4.9% in 1950 to 9.0% in 1980. A population projection based on the 1975 population census assumes a recovery of fertility from a total fertility rate (TFR) of 1.9 in 1976 to 2.16 in 1980 and a gradual decline to 2.1 by 1987, while an alternative projection assumes a continuing fertility decline to a TFR of 1.65 in 2025. According to these assumptions, in 2025 18.12% to 21.29% of the total population would be aged 65 or over and 38.66% to 43.80% of the working age population would be aged 45-64.

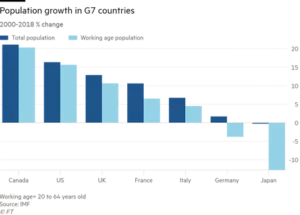

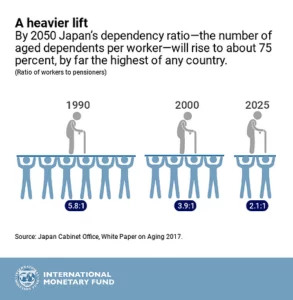

Population changes are transmitted to economic variables through the supply of labor, level of savings, public health care plans, and old-age pension schemes.

Regardless of the population projection and production function used, the growth of the economy is likely to slow to 1 or 0% in the beginning of the next century due to decreased growth of the labor force and a change in its quality due to age-compositional variations. Public health insurance schemes and pension plans will require increasing financial resources as a result of accelerated population aging; depending on the choice of benefit levels, the proportion of national income allocated to them is expected to range from 14%-40% in the year 2010. Per capita gross national product will continue to grow despite decreased economic growth, but savings might be adversely affected if the provision of social insurance benefits continued to increase monotonically. Possible palliative measures would be to change present employment practices or to upgrade the quality of the labor force through vocational training programs for older workers.

Economic implications of Japan’s aging population: a macro-economic demographic modeling approach.

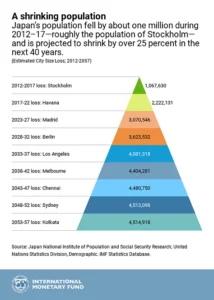

Japan is facing an unprecedented challenge. With its low birth rate, the population has been shrinking since 2010. Japanese people are one of the longest-lived in the world and the population is greying very quickly. No less than 38% of Japanese will be aged 65 and over by 2065, making it the world’s leading “super-aged society.” But while this development has profound implications for economic growth, it also represents a massive opportunity for innovation based on high-quality data and medical research.

Over the next four decades the share of the population aged 65 years and older will rise from its current three-in-ten persons to almost four-in-ten persons. This will depress growth and productivity due to a shrinking and aging labor force and a shift toward consumption, while fiscal challenges will magnify with rising age-related government spending and a shrinking tax base.

A solid plan for fiscal consolidation over the medium and long term is needed to address Japan’s demographic challenges and lessen debt sustainability risks. The planned increase in the consumption tax rate in 2019 will bring much-needed revenue. However, a concrete strategy is needed to stabilize and reduce the large public debt, over the medium and long-term—particularly given an aging population, labor force decline, and rising expenditures for healthcare and other social security programs.